CalBear55 wrote: Wed Oct 22, 2025 10:20 pm

Would like to make sure I’m optimizing our portfolio. Currently at about 5.1 M stock / 2.6 M bond/cash so about 66/34. Would love any feedback.

You said your target is around 60/40 to 70/30 and you’re planning to retire at 40. You didn’t list an int’l stock exposure target but I’m guessing that’s 20% of all stocks. Given a long retirement (55y if you live to 95), I’d probably lean more towards 70/30 now and taper down to 65/35 at say age 55 and then 60/40 by age 65, just as a suggestion to be tailored. As @dogagility mentioned the TPAW Planner will point you towards a suggested AA over time to meet your desired spending levels given the initial portfolio balance.

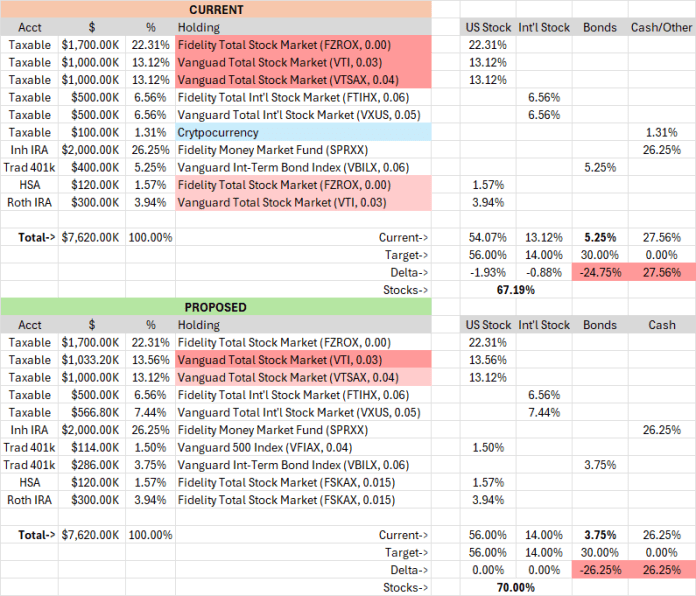

Your Current layout has issues with Wash Sales, which are highlighted in red. You have FZROX in Taxable and HSA. You have VTI and VTSAX in Taxable as well as as VTI in Roth. The crypto is highlighted in blue as a high-risk like an individual stock would be, but you’re planning to replace that so not particularly a concern.

In the Proposed layout I’ve eliminated the Taxable/tax-advantaged wash sales by changing the HSA & Roth to FSKAX, but there’s still a wash sale potential between VTI and VTSAX both being in Taxable. To deal with that probably just means turning off auto-reinvestment in VTSAX and only buying VTI from now on. Sell from VTSAX if you ever need to sell stocks from Taxable and if that sale is a realized loss, do not buy VTI for ±30d before/after the loss-sale date on VTSAX (that means if you plan to sell at a loss, wait 60d to buy VTI, and after 30d execute the loss-sale on VTSAX). In order to meet the 20% of int’l stock exposure I split the $100K crypto between VTI (~$33K) and VXUS (~$67K) in Taxable and also split the 401k between Van 500 Index (assuming that’s on offer in your plan) and the existing Van Int-Term Bond Index. Those changes clear the wash sales (mostly) and exactly meets an AA of 70/30 with 20% of stocks in int’l, where 30% is bonds+cash (i.e., not strictly bonds but “fixed income”).

A template spreadsheet (not your data) to help with asset allocation assessment and rebalance planning is linked below. Make a copy in your local GoogleSheets space to edit (or download to your local machine if you have Excel). It should only take about 10-20 minutes once a year to update your balances and plan a shuffle among funds if any deltas are off by more than ±5% (or whatever your personal rebalance threshold is).

Asset Allocation Sheet

CalBear55 wrote: Wed Oct 22, 2025 10:20 pm

A big expense will be healthcare for our family upon early retirement. Current annual expenses around 215K, mostly elective spending on big vacations.

If you live to age 95 that’s a 55-year withdrawal period so the “4% rule” from the Trinity Study is adjusted from a 30y period to a 55y period by reducing the initial draw from 4.00% to 3.15%, or about $240K. That’s bigger than your stated $215K expenses, but does that $215K include everything (i.e., income taxes and post-retirement savings as well as monthly expenses)?

Table for 4% Rule Adjusted by Withdrawal Period (derivation link)

To get a better handle on your actual spending, start with @KlangFool’s formula to estimate your current expenses: Annual Expenses = Gross Income – Taxes (1040, Line 24) – Annual Savings. Then adjust that by what will change in retirement (retirement savings goes away, but savings for home repair/upgrade, new cars, gifts to children remain; principle & interest eventually go away when mortgage is paid off, but property tax & hazard insurance remain; commuting costs might go down but vacation spending might go up; term life insurance payments might go away but costs for long-term care in late retirement might go up).

The beauty of Klang’s formula is that if you take out taxes and known savings you are spending all the rest of it. We’ve seen posters that had a detailed budget in a spreadsheet or phone app and were surprised to see Klang’s formula show them as much as $50K of unaccounted spending!

The Trinity Study’s constant-dollar withdrawal strategy is best used as a “gut-check” on viability for retiring. Your actual withdrawal strategy should likely be Variable Percentage Withdrawal (VPW) or Amortization Based Withdrawal (ABW), both of which assume you have a significant discretionary portion to your budget and can absorb a “pay cut” from the portfolio draw, in exchange for: a) higher withdrawal rate; and b) leaving a smaller residual to heirs/charity. As an example, the VPW Table in the aforementioned VPW Wiki link suggests a 40y old with a 70/30 AA could draw 4.3%, which is significantly higher than the Trinity Study’s period-adjusted 3.15%. ABW is used by the TPAW Planner, which will recommend a range of AAs to fit your spending with associated success rates. I’ll reiterate @dogagility’s recommendation to try that Monte Carlo tool.

CalBear55 wrote: Wed Oct 22, 2025 10:20 pm

Should I pick something besides SPRXX for the inherited Ira? What to do with the cash?

Given that this account has to be emptied within 10 years and it’s $2M that’s roughly $200K/yr which puts you at 22% Fed without any other income for the year. You could use Total Bond Market (e.g., BND or FXNAX) but that will likely just increase the total amount of taxes paid over the 10y period (and the total after-tax draw), since bonds typically outperform cash for a reasonably long period like 10y (from 1926-2017 bonds were 5.2% while cash was 3.4%). However, you don’t want your Inh IRA to be growing too quickly (because of the relatively short time-frame to withdraw it all), so I wouldn’t put stocks here.