As @ClayfordJCA suggested, you should do the homework to explain your situation using the template for Asking Portfolio Questions as that will get you the most accurate & relevant responses to your specific questions.

kchowdha wrote: Sat Oct 25, 2025 5:16 pm

I have two investment account vanguard and fidelity vanguard

How many dollars in each account and how many dollars in each specific investment?

As an example…

Vanguard

$20K Vanguard Total Stock Market (VTI)

Fidelity

$10K Fidelity Total International Stock Market (FTIHX)

$10K Fidelity U.S. Bond Index Fund (FXNAX)

Instead of dollars, you could provide a percentage of the total of all accounts (e.g., if the two accounts above were everything you owned then VTI would be 50% while FTIHX and FXNAX would be 25% each, total = 100% across all accounts).

kchowdha wrote: Sat Oct 25, 2025 5:16 pm

an old 40k rollover which I 500 a month in but it’s after tax because new employer dsnt offer a retirement plan but a pension

Did you roll the old 401k into a Rollover Traditional IRA? I’m assuming yes, since you’re adding $500/mo to that (and you probably can’t contribute to a 401k that is not your current employer, who doesn’t offer a 401k). You also mentioned that it’s an after-tax contribution, but if your current employer doesn’t offer a retirement plan (they do… it’s a pension), then you would’ve been able to claim a deduction on your taxes for the $6K you’re putting into the Rollover Trad IRA.

kchowdha wrote: Sat Oct 25, 2025 5:16 pm

i have started a Roth with vanguard invested in vfaix I believe I started a fidelity brokerage for some stocks and funds fcntx also spmo, fssnx fspgx … am I overlapping too much I feel might be?

Generally there are two major asset classes: stocks & bonds; and there are two major regions of interest US and ex-US (e.g., Int’l). A simple 3-Fund portfolio provides nearly all the diversification you need with just three basic funds (perhaps five if you have a Taxable account and trying to entirely avoid Wash Sales:

1) Total US Stock Market (e.g., VTI),

2) Total Int’l Stock Market (e.g., VXUS), and

3) Total US Bond Market (e.g., BND)

If you wanted regional diversity for bonds, then you add Total Int’l Bond Market (e.g., BNDX).

You said you have Vanguard Financials Index (VFAIX, 0.09), but you probably mean Vanguard 500 Index (VFIAX, 0.04). The other symbols you listed are:

Fidelity Contrafund (FCNTX, 0.63) – a moderately expensive actively managed fund, not a passive index per Boglehead Philosophy

Invesco S&P 500 Momentum (SPMO, 0.13) – This fund only holds 100 stocks but they are all overlapped with VFIAX, so it’s a bet on outperformance

Fidelity Small Cap Index (FSSNX, 0.025) – A good low-cost small-cap index to complement the large-caps in VFIAX

Fidelity Large Cap Growth Index (FSPGX, 0.035) – low-cost LCG index, but it’s a tilt towards growth and overlapped with VFIAX, plus it’s a bet on outperformance

So, yes you have overlap and could simplify to something less overlapped like a 3-Fund portfolio.

An example layout of the 3-Fund Portfolio that adheres to Tax-Efficient Fund Placement and also avoids Wash Sales might look like this (these ETFs could be swapped for similar ETFs or mutual funds based on whatever funds/ETFs you prefer or have available):

Taxable

Total Stock Market (VTI)

Trad Tax-Deferred

S&P-500 (VOO)

Total Int’l Stock Market (VXUS)

Total Bond Market (BND)

Roth Tax-Free

S&P-500 (VOO)

Total Int’l Stock Market (VXUS)

kchowdha wrote: Sat Oct 25, 2025 5:16 pm

I feel might be better to combine everything into one larger or 2 accounts.

Consolidating everything to one brokerage is simpler to deal with. If you do that, I’d probably suggest Fidelity as they supposedly have better customer service than Vangaurd, but Fido’s money market funds pay the lowest yield (due to the highest ER) among Van, Schwab, and Fido. Some investors also don’t like all their eggs in one basket. Most all of my assets are at Vanguard (with a small account at Schwab that they acquired from TD Ameritrade).

It’s your call; if you like the simplicity of only dealing with one brokerage then consolidate at Fido. If you concerned Fido might have a glitch that locks you out, then keep your account at Van so you always have access to some of your funds (it’s pretty unlikely that both Fido and Van would lock you out simultaneously due to a mostly-harmless glitch, but that could happen if your identity is comprised and all financial institutions lock you out around the same time due to fraud-like activity detected in your accounts).

kchowdha wrote: Sat Oct 25, 2025 5:16 pm

Any thought I’m playing kinda catch up since I’m 60 and my ex took half. Help

You probably need to read up on personal investing so you: a) understand the basics of what your investing in and why; asset allocation (AA) based risk & reward; and b) that you can develop a solid plan by which to self-manage your portfolio.

Getting Started

Read the five introductory topics in Wiki Main Page (left side) under “Getting Started for US Investors”:

1) Getting started – Start here.

2) Investment philosophy – Our investment principles.

3) Investing start-up kit – A top-down approach to start investing.

4) Investment policy statement – Identify your investment objectives and how you plan to meet them.

5) Prioritizing investments – Choosing where to save your investing money, such as an employer’s retirement plan or a savings account.

Book Suggestions

The Bogleheads’ Guide to Investing (Lindauer)

The Little Book of Common Sense Investing (Bogle)

Common Sense on Mutual Funds (Bogle) <– personal favorite

If You Can – How Millennials Can Get Rich Slowly (Bernstein) <– free & brief online PDF

The Wiki also has a Suggested Reading List.

———-

First and foremost, you’ll want to choose a desired AA among stocks and bonds, as well as an int’l exposure level (as a % of all stocks) as that’s the blue-print for managing your portfolio.

Control Your Risk

1) Read the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was recommended by the quiz based on your knowledge of your personal risk tolerance having read the Wiki article.

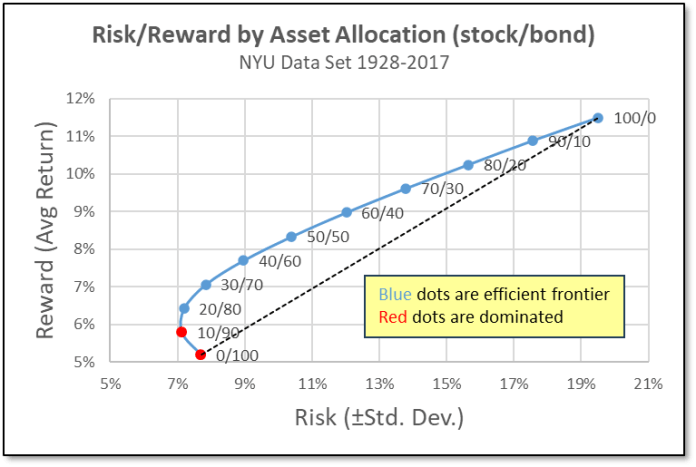

2) Alternatively (or in addition to), ask “How much of a drop in portfolio value as a % of total value can I handle?” cut that % in half to get standard deviation, then lookup that std. dev. on the X-Axis of the chart below, and finally scan up to see what AA that corresponds to. As an example, if you can only stomach a -24% drop in portfolio value, that’s a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is an average and you’ll get what you get with your unique sequence of returns (there’s a lot of variance in outcomes due to the associated volatility of stocks so it probably will NOT be the average, but something more or less).

a. For a long time-frame (>10 years) AAs below 20% stock are dominated (red dots) by another AA with similar risk but higher reward (blue dots).

b. The dotted line represents a hypothetical linear risk-reward from 100% stocks down to 100% bonds; the historical risk-reward curve has an improvement for risk-adjusted return due to the lack of correlation between stocks & bonds.

Vanguard’s Target Date Retirement Glide-Path Design is a also a good starting point for choosing an AA. The choice of a specific TDF year should not solely be based on age, but could be ahead or behind your expected retirement age based on your personal risk-tolerance.

Value of Int’l Diversity from US

There’s essentially two camps among Bogleheads: a) Those that are on board with the global market cap weighting, which is about 60% US stock and 40% ex-US stock; and b) those that have a home bias (US will usually outperform), which is about 80% US stock and 20% ex-US stock (some even omit Int’l altogether). I’m in camp a) based on the chart below from WisdomTree, the white paper from Vanguard, and the more recent article from Vanguard.

Vanguard White Paper: International Equity – Considerations and Recommendations

Vanguard Web Article: Making the case for international equity allocations

———-

Personal Finance is distinct from Personal Investing. The former is about budgeting, short-term savings for lumpy bills and covering all bills in case of a lay-off (emergency fund), term life insurance, combined savings on home & auto & umbrella, estate planning for heirs/charity, etc. The latter is mostly about developing a risk-tolerance based plan to reach your retirement goals and then annual assessment & rebalance to stay on track with your desired AA. For broader personal finance stuff you could check the right-side main Wiki page for:

a) Personal finance planning start-up kit – Start here.

b) Financial planning – The first thing you should do.

c) Household budgeting – Understand how much you make and how much you spend.

d) Emergency fund – Have cash on-hand for life’s unexpected events.

e) Insurance – Auto, home, medical

f) Estate planning – Be prepared when bad things happen.

I also like Eric Tyson’s Personal Finance for Dummies. That book that pointed me towards Vanguard and the Vanguard Diehards forum on Morningstar (which eventually transitioned to Bogleheads here) and was probably the best $15 I ever spent on securing my future.