bonesly wrote: Fri Oct 24, 2025 2:28 pm

DanZel wrote: Wed Oct 22, 2025 11:26 am

I’ve determined that with $5.4M I can safely withdraw $180k annually pre tax and accomplish my goals.…

Age: 54M / WIFE 52

$180K / $5,400K = 3.33% initial withdrawal rate

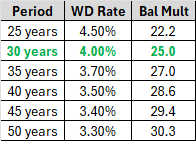

If you retire in 2 years (24 months), she’ll be 54 and if she lives to 95 that’s a 41-year withdrawal period. The Trinity Study’s “4% for 30y” guide is adjusted to around 3.5% for a 40y period. The Trinity Study uses a constant-dollar strategy, but if a significant portion of your $180K draw is discretionary (vs mandatory), then you could likely draw a higher amount under a flexible spending plan using Variable Percentage Withdrawal () or Amortization Based Withdrawal (used by the ). For example, the VPW Table suggests a 54y old with a 60/40 AA could draw 4.4% in that year which is about $237K (vs $180K). VPW and ABW tend to leave a smaller residual to heirs/charity although such a legacy can be a “set aside” from your portfolio and VPW/ABW applied to the remainder if you wish to leave a legacy rather than “die with zero.”

Alternatively, if you really only need $180K (in future inflation-adjusted dollars, not today’s dollars) then your future balance goal might only be $180K / 3.5% = $5,143K vs $5,400K.

Table for 4% Rule Adjusted by Withdrawal Period (derivation link)

Can you verify what your expense ratios (ER) are? You have seveal funds that have “TR” in the name which implies a unit trust, which may have lower costs than a retail ETF, but you also provided ticker symbols. If the Ticker symbols are correct (when you look at your online accounts), then the costs you listed are probably not correct. As an example the first 5 funds you listed have these discrepancies against a Morningstar Quote of the ER:iShares AI Innovation & Tech (BAI); ER = 0.07 (you) or 0.055 (M*)

iShares US Equity Fac Rotation (DYNF); ER = 0.00 (you) vs 0.27 (M*)

iShares MSCI EAFE Growth (EFG); ER = 0.34 (you) vs 0.36 (M*)

iShares MSCI EAFE Value (EFV); ER = 0.34 (you) vs 0.33 (M*)

iShares Core International Aggt Bond (IAGG); ER = 0.34 (you) vs 0.07 (M*)

For now if you’ve listed a symbol I’m using the M* quoted ER, but if you verify that the ERs you originally listed are correct, that will just shift the priority for simplifying your portfolio (assuming you’re self-managing this, because this excessive amount of expensive funds surely looks like the dastardly work of an Edward Jones-style advisor).

The ERs I provided were not as accurate as they should be. I just pulled away from a money manager and so the excessive number of investments are from the several funds they had me invested in. That is also why there are duplicates. I’ve migrated everything I could to Schwab and would like eventually to convert the multitude of funds into a 3 fund BH portfolio.

I see duplicates under Taxable (e.g., BAI with $5,629 and again with $5,917), so I’m assuming the first listing is “His Taxable” and the second listing is “Her Taxable.” It’s important to distinguish because if you both hold the same ticker symbol (or even a “substantially identical” one that isn’t the same symbol) and one of you sells at a loss and the other buys within ±30d of the loss-sale date, then you have a Wash Sales, which will likely complicate filing your taxes correctly.Thank you for the heads up about the wash sale! I was not aware.

Also are her Inherited Funds at Schwab in her Trad IRA or are they in Taxable? Same question for her annuity–is it sheltered or in Taxable generating income? I’ve assumed Taxable for now.Her Inherited Funds at Schwab are in her Traditional IRA. Her annuity is tax deferred.

———-

Portfolio AnalysisGiven the outstanding questions above, here’s a preliminary analysis of where you’re at (relative to your 60/40 with 30% int’l target).

Your Current layout is about 47/16/37 with about 14.7% of stocks in int’l and is comprised of a whopping 65 holdings. Only 8% of your holdings are in Traditional Tax-Deferred accounts so the vast majority of any cost-reduction & simplification effort is going to incur a Tax Cost to Switch Funds. Eliminating the the robbery-level ERs (anything over 0.30 is bad, but over 0.60 is likely on the “replace this quickly” to-do list) and replacing any tax-inefficient bonds & cash in Taxable accounts with tax-efficient stocks is likely a priority for both your total return and reducing your tax bill (important at 43.85% combined Fed+NY tax rate).

More than 3-5 funds is NOT more diversification unless the funds you add beyond a core 3-Fund Portfolio are uncorrelated with what you’re already holding. A 3-fund portfolio of Total US Stock, Total Int’l Stock, and Total US Bonds is very simple to manage (annual assessment & rebalance of <1 hr/yr) and is plenty diversified (you could add Total Int’l Bonds as a mitigation against US bond regional concentration similar to what Vanguard Target Date Funds and LifeStrategy funds do). So 65 funds is completely unnecessary complexity, probably added by your advisor to make your portfolio “sticky” (difficult to unwind and looks so complex you think you need a CFP just to manage it; you do not!).

I walked away from my “manager” as I came to learn more about the Whole Life Policy they had me in. There is a mess here to clean up and I look forward to simplifying this. It’s ridiculous and the result of my negligence and focus on just making money in the business. My daughters will have much simpler portfolios!

Issues:1) Almost 36% of your total portfolio is cash in a Taxable account. That interest is fully taxed at 43.85% combined ordinary tax-rate, which is not tax-efficient (highlighted in purple). If you need that much cash (your desired AA is 60/40, no cash), then use the concept of Holding Cash in a Tax-Deferred Account.

I’m looking into MUNI / VNYUX to hold the FI until I retire because I don’t “need” returns to get to the $5.4M in the timeframe I have in mind. I can do that with the RE sales and business income. But this is part of a bigger question, ie. the strategy to get through the next 2 years and wind up with the portfolio I need. At that point I believe I’d shift to 60/40 or maybe even 80/20 fairly quickly.

2) Almost 7.5% of your total portfolio is nominal bonds in a Taxable account. The preferred placement for bonds is in Trad Tax-Deferred accounts per Tax-Efficient Fund Placement, but your Trad accounts aren’t big enough to hold all your bonds, so any bonds you have to hold in Taxable should be low-cost Tax-Exempt national municipals like Vanguard Tax-Exempt (VTEB, 0.04).

I just learned the wisdom of this through the link and agree. Thank you again!

3) You’re holding the same funds across different accounts which opens you up to wash sales as noted previously (highlighted in red).Noted

4) You have moderate-to-high cost funds that are more than likely reducing your total return (e.g., a 1.00% ER on a fund that earns 10% before costs is paying 10% of the earnings to the fund manager!). These are highlighted in yellow with the ER in red and should likely be replaced with a low-cost, broadly diversified index like VTI/IVV, VEA/VXUS, BND/BNDX (in Trad Tax-Deferred), or VTEB (in Taxable).Thank you and I couldn’t agree more. If only I had somehow learned more about BH 10 years ago…

5) There are four different TDFs in His & Her 401k accounts… this is useless clutter. If you’re going to use a TDF just pick one that most closely matches your desired AA.My mistake. I didn’t understand that each fund corresponded to a different contributor. SHE is in the 2035 TDF and I’m in the 2040 TDF. The non-prorated amounts which I should have used are HER $101,627 and ME $103,299. I’m migrating this to Schwab and was looking for advice on using SCHB to let these funds grow maximally over the long term in this 401k.

6) Complexity is out of hand! Perhaps your advisor has an automated lookup to identify how your holdings are split among US Stock, Int’l Stock, US Bonds, Int’l Bonds, Cash and Other (e.g., gold), but I looked up these symbols manually on Morningstar and it took a ridiculous amount of time to assess what you have. A simple 3-Fund portfolio wouldn’t require looking up the composition since each fund only occupies one column; you just have to check the balance of each holding to do your assessment in maybe 10 minutes once a year. Maybe another 10 minutes to plan a proposed rebalance if any deltas are more than ±5% off target. if you’re self-managing your portfolio in retirement (which will improve your total return by significantly reducing costs & complexity), then you’ll want to slowly unwind all this clutter, prioritizing tax-efficiency and then reducing cost of ownership.I completely agree. This will become another small, part time job…

The Proposed layout is just an example of how easy it would be to assess & rebalance a 3-Fund portfolio. However, executing this all in one fell swoop is not recommended because the tax-cost would be to massive (assuming you have lots of unrealized capital gains in Taxable holdings).We do and I’m just seeing the details come in now that they’re listing in Schwab. Ouch!!

It’s a holistic view of His & Her accounts as a unified portfolio, so he holds all the int’l stock in Taxable and she holds the vast majority of tax-exempt bonds in Taxable. The Trad tax-deferred accounts are all low-cost Total US Bond index funds (this means replacing the annuity in 2 years or surrendering it if the surrender fee is reasonably low so you can put it into muni bonds and improve tax-efficiency). This propsoed layout avoid wash sales entirely, adheres to tax-efficient fund placement, and exactly meets an AA of 60/40 with 30% of stocks in int’l (no int’l bonds, although you could split the bonds in Tax-Deferred into US & Int’l). This also reduces your massive 65 holdings count down to 10 which is much more manageable. “Simplicity is the master key to financial success.” — John C. BogleBrilliant suggestions! Thank you!!

The spreadsheet above to help with asset allocation assessment and rebalance planning is linked below. Make a copy in your local GoogleSheets space to edit (or download to your local machine if you have Excel). It should only take about 10-20 minutes once a year to update your balances and plan a shuffle among funds if any deltas are off by more than ±5% (or whatever your personal rebalance threshold is).

Asset Allocation Sheet

AA Current and Proposed_DanZel

As noted before, the proposed layout is an ideal example. You might try to partially get to that ideal over the next 2-5 years by unwinding positions you decide not to keep up to a “tax pain threshold” each year, repeating the unwinding process each year until it’s cleaned up “enough” (e.g., to your satisfaction, which may include retaining some low-cost impact clutter).Understood and agreed.

A suggested prioritzation table for unwinding that is given below with tax-efficiency (in purple) at the top of the list, followed by reduced cost-of-ownership (ranked by $ x ER from largest to smallest). Notice that the ER alone isn’t the biggest factor in cost-of-ownership, so Impax Sustainable Allocation (PAXWX) with a horrendous 0.93 ER is low-priority because you only have $2K of that, while the largest holding is iShares National Muni Bond (MUB, 0.05) at $127.3K, but that’s low-cost and tax-efficient in a Taxable account. Top priority are the tax-inefficient funs (TLH, IUSB, IAGG, MBB, and the annuity if it can be surrendered and principal returned at reasonable cost). Next priority is reduced cost-of-ownership (e.g., PORTX, BAWAX, NSBRX, PARMX, CAAPX, etc.). Also note that even though iShares High Yield Muni (HIMU, 0.42) is tax-efficient, it’s not low-cost and that ER directly reduces your total return from that fund, so it’s pretty high on the list of things to replace. Ideally none of your holdings have an ER > 0.10%; maybe as much as 0.15% if you want a TDF or LifeStrategy type fund, but that’s only “easy” if you use the same singular TDF date in every account and it’s not tax-efficient to hold such funds in Taxable, nor is optimal to have bonds in a Roth, so still better off with a simple 3-Fund portfolio.These are such excellent observations. They are examples with numbers that clarify the principles. Thank you so much for being so clear!

Clutter Unwind Priority Table

———-

[

b]Can You Retire in 2 Years?[/b]This is just a ballpark and like all estimates using Monte Carlo models, will have inherent uncertainty. It’s just to get “a feel” for how much confidence you should place in your plan to retire in 2 years with $5.4M. Your total contribution over 2 years is $40K/m x 24m + $760K + $850K = $2,570K. Let’s just call that $1,285K/y for a rough cut at annual contributions. If we start at her age 52 and go to her age 54 with an AA of 60/40 then the range of projected balance outcomes looks like this:

End-Bal Percentile

$5,168.8K 10th

$5,394.7K 20th

$5,920.0K 50th

$6,462.0K 80th

$6,807.9K 90th

That 10th percentile balance represents a bad sequence of returns (90% of the 1,000 trials were better than this). That $5,170K balance supports an initial 3.5% withdrawal of $180.9K, which is $170.5K in today’s dollars assuming +3%/yr inflation. That’s a little shy of $180K spending in “today’s dollars,” but there’s an 80% chance you’d have the 20th percentile balance or higher and $5,400K supports an initial draw of $188.8K, which is $178K in today’s dollars and is likely close enough for Const-$. If you’re using VPW (or ABW) instead of Const-$ as your actual withdrawal strategy then I’d say your plan to retire is fine.

Thank you for running through that. I have been careful about tracking our household budget for several years and have been conservative at about $155k in 2025. No mortgages or debt, 529k filled for both kids, spent the last 5 years improving the home so all large cap ex items are updated, have late model cars, and property tax here is a killer and will decline once we downsize. So I’m estimating about $162-$164k 2 years from now. If I’m only selling stocks worth $180k each year then my net after tax is around $163k. I realize that’s simplistic but I haven’t had the time to learn how I’d actually get paid from the portfolio. I have 2 years to figure that out and if I need to work a little while longer to cover that or cover the nastiness of the unrealized gains then I will.

The results above are from my Accumulation Monte Carlo, which is linked below the image along with other models that don’t require Excel. I’d strongly encourage you to “gut-check” your specific scenario using the TPAW Planner.Data and Models I use for Monte Carlo:

NYU Data Set 1928-2017 with Model Fits

Accumulation Monte Carlo <- Image above

You’ll need a MS Excel license; download to your local machine and enable macros (required for the 1,000 random trials and results aggregation).

I’m using my own model as I like to know what’s under the hood, but there are other models I like that have public facing website interfaces:

TPAW Planner (probably most comprehensive, supports ABW), <- Try this one!

Portfolio Visualizer’s Monte Carlo (also their Financial Goals model is nice),

Engaging Data: Rich, Broke, or Dead, (uses historical returns in a cycle for your retirement duration), and

FireCalc (also historical data, but lots more inputs to tailor to your situation).

Paid models sometimes cited here include Boldin (formerly NewRetirement) and Pralana Gold as well as many others (just citing these not recommending for or against on any of these).

Standard caveats about simulations apply (those using 30y rolling periods suffer from small sample size for estimating a binomial proportion as the success rate and those using a large sample size as random draws from a distribution assume the distribution is constant over the withdrawal period; all sims suffer from assuming the future looks like the past in one way or another).

Thank you for all the suggestions and tools. It gives me more to research. I watch Rob Berger’s comparsion of Boldin vs Pralana and bought the online Pralana and have found it very simple and powerful.

I mentioned another strategic question above (in this reply). If I can get to $5.4M through RE sales and income (not needing returns from the portfolio) then it seems the most conservative path through that is to put all of the current cash, the $40k/month, and the RE sale proceeds into fixed income. I would still have stocks at that point, although possibly I’d have reorganized into VT or similar. I’ve been trying to think through 2 alternatives: 1) add the inbound income and sale to the portfolio so that I’m balancing around 60/40 vs. 2) add all the inbound income and RE sales into fixed income (MUNI or VNYUX?). At this point I feel largely convinced that, in the long term, I’d like to have a 70/30 or 80/20 AA because over the LONG term I think that works best. But I have a very short term of 24-30 months in front of me to get to a certain goal and I’m wondering if option 1) is just too risky. From the backtesting I’ve done around downturns it’s entirely possible that I could wind up delaying my 2 year timeframe considerably. I would keep working and when the market returned I have more that my $5.4 because I wouldn’t sell. I’d persist in accumulation mode. But I don’t want that end date pushed out too much and I’m thinking the “safest” way is option 2. Any further guidance would be greatly appreciated.

You’ve been extremely generous in sharing your knowledge and I hope to gain enough insight to one day contribute in same way to this community!!

“All models are wrong, some are useful.” – George E. P. Box