CalBear55 wrote: Mon Oct 20, 2025 11:02 pm

I want to retire (40ish). May return to work force in a different career or possibly just work some part time “fun” jobs.

As stated by @id0ntkn0wjack, retiring at 40 and living to 95 is a 55y withdrawal period, so the common 4% for 30y safe withdrawal rate is reduced to 3.15% for 55y. 3.15% of $8M is $252K in year-1 (and adjusted for inflation every year thereafter). Is $252K enough to cover income taxes (Fed + State), post-retirement savings (home upgrades/repairs, new cars, big/fancy infrequent vacations, other lumpy expenses you save for), and your post-retirement monthly expenses?

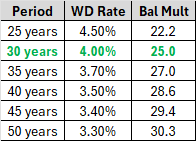

Table for 4% Rule Adjusted by Withdrawal Period (derivation link)

You could likely draw more than 3.15% in year-1 if you have a significant discretionary portion for your retirement expenses. If your spending is pretty flexible then you can use Variable Percentage Withdrawal (VPW) or Amortization Based Withdrawal (ABW) used by the TPAW Planner. The VPW Table in the Wiki suggests a 40y old with a 70/30 AA could draw 4.3%, for example, in exchange for leaving a much smaller residual to heirs/charity than the Constant-$ strategy of the Trinity Study (e.g., “die with zero”).

CalBear55 wrote: Mon Oct 20, 2025 11:02 pm

I realize I probably need to get out of ~95 equity.I think the easiest move would be to convert my inherited IRA to some sort of fixed income, but I don’t know if it should be in TIPS, Bonds, other?

…

What would you do?

I’d probably figure out what my risk-tolerance based target AA is and use that to guide the percentage of bonds needed in my total portfolio (and you’re right to try and place all the bonds in a Trad Tax-Deferred IRA as that is the preferred Tax-Efficient Fund Placement). Consider one or both of the exercises below to figure out your AA.

Control Your Risk

1) Read the Wiki article for Assessing Risk Tolerance, take the Vanguard Investor Questionnaire, then tailor the asset allocation (AA) that was recommended by the quiz based on your knowledge of your personal risk tolerance having read the Wiki article.

2) Alternatively (or in addition to), ask “How much of a drop in portfolio value as a % of total value can I handle?” cut that % in half to get standard deviation, then lookup that std. dev. on the X-Axis of the chart below, and finally scan up to see what AA that corresponds to. As an example, if you can only stomach a -24% drop in portfolio value, that’s a ±12% std. dev, which corresponds to an AA of 60/40. The return you get is an average and you’ll get what you get with your unique sequence of returns (there’s a lot of variance in outcomes due to the associated volatility of stocks so it probably will NOT be the average, but something more or less).

a. For a long time-frame (>10 years) AAs below 20% stock are dominated (red dots) by another AA with similar risk but higher reward (blue dots).

b. The dotted line represents a hypothetical linear risk-reward from 100% stocks down to 100% bonds; the historical risk-reward curve has an improvement for risk-adjusted return due to the lack of correlation between stocks & bonds.

Vanguard’s Target Date Retirement Glide-Path Design is a also a good starting point for choosing an AA. The choice of a specific TDF year should not solely be based on age, but could be ahead or behind your expected retirement age based on your personal risk-tolerance.